Originally published on Portfolio Institutional by Andrew Holt, Deputy Editor.

One theme being covered across all media everywhere is that of artificial intelligence (AI). The Competition and Market Authority, a regulator, is investigating AI. Its impact is set to be as big as the industrial revolution, former government chief scientist Patrick Vallance has said, while US President Joe Biden has made it a priority to encourage big tech bosses to make AI safe.

Indeed, safety concerns usually dominate conversations on AI, with much coverage often accompanied with the vision of Armageddon and the mandatory pic of Arnold Schwarzenegger dressed as the Terminator to illustrate the point that AI could lead to nothing but darkness.

Even the chief executive of AI specialist OpenAI, Sam Altman, acknowledged the concerns over AI during an appearance at a US Senate sub-committee hearing in May. He went as far as calling on Congress to create licensing and safety standards.

OpenAI is the company behind ChatGPT – an advanced AI chatbot which can make human-like conversation. It is a bad day when one of your own innovators questions the validity of what is happening in the AI space.

But there is another narrative, albeit one that is drowned out by the noise around the dangers of such an innovation: one in which AI contributes to the overall good, providing a pathway to progress and offering numerous benefits along the way.

To get to grips with AI, Martha Lane Fox, a technology guru and president of the British Chamber of Commerce, calls for more understanding on the impact and importance of AI. “You need to get educated about it as an individual. Whether you are a business leader, investor, work in a charity or in the public sector, it is going to impact how you do your job,” she says.

Three stages

This raises big questions about what it could mean for the investment industry. Given its prevalence everywhere else, it is not surprising AI is being discussed in such an arena. And it seems, on an initial view, that asset owners find AI appealing. That is if a CFA Institute Investor Trust Study is a suitable guide.

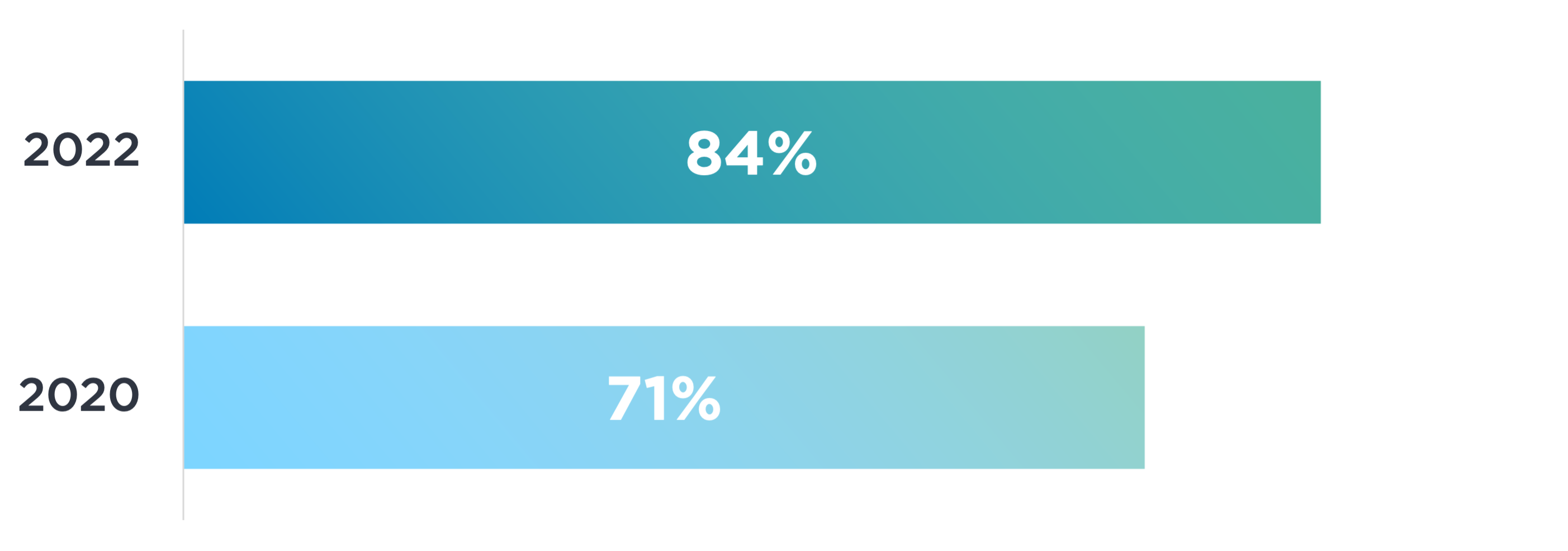

84% of institutional investors say ‘yes’ to AI in the investment process

This found that 84% of institutional investors want to invest in funds that use AI and a similarly high level (78%) believe that the use of AI in investment decision-making will lead to better investor outcomes. This appears a pretty unequivocal endorsement of AI from investors.

But this is far from the full story. Although investors are positive about AI, how they are approaching it is far more complex.

Larry Cao, senior director of research at the CFA Institute, reveals that further surveys give a more in-depth look at how investors are embracing AI. Or rather, how they are not.

“We believe AI adoption amongst investors is a progression,” he says. “There are those not doing anything on it. That bucket accounts for about 30% to 50%.”

This indicates that while investors find AI appealing, the level of commitment is open to question. In fact, Cao highlights the three stages of AI adoption that investors are following.

The first is at an early stage: when investors are doing something, say within one geographic area or one functional department.

The second, a more intermediate stage, is more sophisticated: one where investors have a more strategic approach to the issue of AI, while using a greater co-ordination between investment functions.

Then there is the more advanced stage, where all investment functions, strategies and geographies are using AI. “We see few [investors] in the advanced stage,” Cao says. “We also see few in the intermediate stage. In total, for both we are talking about 20% [of investors].”

When looked at in this way, AI presents an option for a small number of investors.

With most investors sitting within the experimentation phase of AI, this probably should not be a surprise, given it is such a new technology.

Explaining what is happening here further, Cao adds: “A large number are experimenting with AI in different ways. That is where the bulk of investment organisations are, making a chunk of about 40% to 50%. We do see numbers inching up, but it is a gradual process.”

Different beasts

Endorsing this picture of a gradual growing interest, Federico Invernizzi, chief operating officer at AI specialist MDOTM, says asset owners are showing an interest in AI, but have particular requirements. “It is a little different, given that they are a different beast from an asset manager,” he says.

He then lists asset owner requirement in regard to AI. “They are more interested in portfolio analytics, asset allocation and funds selection, which AI can assist with, but, of course, it needs customisation and you need to understand it is not about adding AI per se but more what they are trying to solve.” There are other points of focus for asset owners.

“Typically, you end up looking at longer time horizons, fewer asset classes and a little more alternative assets,” Invernizzi says. “So it changes a little from the point of view of asset owners [versus asset managers]. But yes, there is a lot of interest from asset owners.”

Lorenzo Saa, chief sustainability officer at Clarity AI, a sustainability AI platform, agrees, saying that asset owners are showing a “cautious excitement” towards AI. “We have a client base of asset owners who are certainly keen to leverage the power of AI,” he adds. “They often come to us with a desire to know more about how our team of experts – data scientists and sustainability experts – work not just with the AI, but as the masters of the AI, those who are in charge of it.”

Net zero

In his discussions with asset owners, one example he has seen resonate is around the use of Natural Language Processing, or NLP. This is used by Clarity AI to measure the quality of net-zero transition plans at scale in an automated fashion by identifying whether they contain all the necessary elements.

This effectively allows asset owners to scale the evaluation of transition plans across entire portfolios and for a better forward looking view of how their holdings are likely to perform in the future.

Returning to the three stages of progress in AI, Cao believes the intermediate stage could prove to be the most popular option for investors going forward. “This means investors use AI in some of their core functions, and correlation across functions across business units and geographies.”

But this does not mean AI will be rejected – far from it.

The benefits in differentiation may well present themselves more to asset managers, then asset owners, says Axel Maier, a partner at MDOTM. “Financial institutions that can successfully leverage this new technology and platforms will be more likely to grow their market share, launch new innovative products and enhance the results they deliver to final clients,” he adds.

But like much of AI, the differentiator picture it is not a simple trajectory of success. “As AI progresses, there will be winners and losers,” Cao says. “The winning organisations will be those that fully embrace AI plus human intelligence (HI). You need the investment expertise and then use AI to scale it up. This is therefore not using AI to take over the investment world.”

AI meets HI

This is a crucial point. One in which AI works best when combined with HI: the best, essentially of man and machine. “The winning organisations will be a smaller number but will focus on that split between AI and HI,” Cao says.

When I ask what AI offers asset owners, Lorenzo Saa has a similar logic mix of AI and HI in his outlook. “Think about it like chess. AI beats humans, but AI plus humans beats AI,” he says. “The reasons the two are better together is that there is certainly a competitive advantage to using advanced technology to gain efficiency and scale, but using AI alone would limit the ability to strategically predict what will happen in the future.”

Working on this theme, Saa adds: “Thinking many, many moves ahead is something AI plus humans will win at when pitted against AI alone. Future-forward thinking is exactly how asset owners invest for the long-term,” he says. “That’s how our team of data scientists and sustainability experts are designing our solutions and thinking about the long-term.”

There is a responsibility to look at how the here and now affects the long-term, Saa says. “Not using AI doesn’t make sense, but again, not using AI plus humans really doesn’t make sense. “Asset owners, and everyone else, should want and get the benefit from the best of both worlds – and that’s in the combination of AI, governed by humans.”

AI in springtime

So the consensus has it that the mixture of AI and HI is central to bringing the best out of AI from an investment viewpoint. “We believe we are in the springtime for AI and looking forward to an impactful summer,” is how Robbie Henderson, global research analyst at Newton Investment Management, colourfully puts it.

“The deep learning paradigm shift is central to this view,” he adds.

The two ingredients necessary in creating AI or learning machines, Henderson says, is incredible computing power and an abundance of data. “Moore’s Law [on historical trends] has driven exponential gain in computing power and continues to do so,” he adds. “In the past two years we have doubled the performance that was achievable. That sounds impressive, but what it really means is we have travelled as far in the past two years as we have in the previous 40.”

And on the data aspect, Henderson makes a similar point. “The good news is we have lots of data. In fact, 90% of the world’s data was created in the past five years.”

Altogether, on these important parts of computing and data, it highlights the speed at which the issue of AI is developing.

AI predicts

And, of course, advocates of AI, often AI companies wanting to sell their wares, along with some asset managers, are not shy in promoting its benefits.

One specific point is the ability of AI to conduct thorough investment analysis gives it better forecasting and predicting skills, compared to a human being. This, the argument goes, is particularly useful in addressing risk management.

AI also avoids the suggestibility of news cycles and market peaks and troughs. Although many institutional investors would retort they seldom are, given they furrow their own strategy or long-term objective.

AI also has the ability to make a dramatic impact on ESG investing – accounting for environmental, social and governance risks and opportunities in investing. And while AI can unearth key data for investors seeking sustainable investments, discerning unreliable information will be a key challenge, meaning humans will not be replaced any time soon.

But the shadowy part of AI is never far away. Martha Lane Fox warns that the threat from AI is real and needs big oversight. “We need to think at a supra-national level about this,” she says. “Some countries will be developing this technology for nefarious purposes and could lead to a global AI arms race.” In such a scenario, the picture of Arnie as the Terminator returns, but this time, controlled by human activity.

The narrative of AI taking us into some form of future hell typically emanates from one place: the ethical considerations of AI, or the lack thereof. “There is a lot of research from the technological side about the ethics of AI,” Cao says. “Data privacy and data governance are the major concerns.”

He adds there is a simple way to avoid the problems that could emerge here. “Our view is the technology people should deal with the technology and ethics of AI, and investment profes- sionals should deal with the ethics in investments,” he says.

AI builds

From this, Cao says there is an important point about how investment teams need to be specifically built to deal with the challenges of AI. He says the necessary skills come in the form of so-called T-shaped skills – made up of investment, innovation and technology expertise – creating an environment that has investment specialists and AI specialists.

“Not everyone is going to have T-shaped skills,” Cao says. “You can have specialists on the team, but overall, as a team, they need to have T-shaped skills connecting AI technology with the investment professionals.”

Such a team would only need to be a “handful of individuals”, Cao says.

Many of the asset owners portfolio institutional spoke to said they were looking at AI but would not comment further. This endorses Cao’s view that many institutional investors stand at the experimental stage. One that is doing so, in a little more advanced way, is the Surrey Pension Fund.

Neil Mason, assistant director and local government pension scheme senior officer at the Surrey Pension Fund, points out that he sees AI within a wider technology development. “Digital transformation is the hottest topic when speaking with business leaders in any industry, and this is no different with pensions,” he says.

And Mason adds that there is a need to not only adapt to change, but the challenges connected to it. “There is no doubt that the ‘art of the possible’ is expanding rapidly with technological advances and no one can afford to sit still,” he says. “Dramatic headlines about AI and the roller-coaster ride surrounding bitcoin and non-fungible tokens make it difficult to make sense of how to progress and positively harness new tech.”

AI transformation

But Mason concludes that it is ultimately helping to develop his, and the fund’s, thinking. “In the Surrey pension team, we are at the start of a digital transformation programme which will specifically focus on how AI and automation can mechanise our service delivery function.

“We are fortunate that we are able to focus so explicitly in this area since many digital transformations struggle to identify target areas and spread their efforts too thinly. We are committed to resourcing our programme appropriately – another pit fall for others in the digital race – and will be working in close partnership with some of our key suppliers.”

Mason also notes the importance of up-skilling his team, in the way Cao highlights, while also again acknowledging the challenges. “We also know that we will need to up-skill our people and bring in specialist skill sets to help us with our journey. Attempting to gear up for the future in an environment where there is such rapid change is exhilarating and terrifying in equal measures. But we are buckled up and ready to start the journey,” he adds.

But for many investors the issue of how AI will work as a useful investment tool can be difficult to comprehend. In an attempt to address the many grey areas surrounding AI, Deloitte has offered investors a route through the AI maze with a five-pronged approach in how to embrace it effectively.

AI tools

The first is to clearly define an AI strategy. This may sound simple, but it is important in articulating an understanding of how AI will be utilised as part of the investment model. A key part of this will be the need to evaluate the implications from a risk perspective.

The second is to determine the AI path going-forward. Here a so-called ‘pilot, prove and scale approach’ will demonstrate business value. Firms can start by identifying, evaluating and presenting options for creating value.

Third, is for investors not to be distracted from understanding and appraising the long-term implications of AI. And in so doing, make the appropriate investments in talent and technology needed for the transformation ahead.

Four, embrace strategic collaborations and partnerships to solve issues collectively and benefit from collective ideas, shared capabilities and investment. This will enable investors to sustainably develop differentiated products and services.

Five, work with industry stakeholders and engage with indus- try associations and regulators. As a successful wide-scale adoption of AI in investment management will require rms to work with a broad set of stakeholders. The issue here, it could be noted, is whether such groups are themselves up to speed on the issue of AI.

“The AI journey will undoubtedly be challenging, but the opportunities for investment management firms will be transformative,” concludes the report.

Indeed, there are some huge forecasts on how big AI can become. According to McKinsey, by 2030 AI technologies will generate more than $3.5trn (£2.8bn) worth of value. PwC predicts a 14% boost to global GDP by the end of the decade, thanks to AI – a much welcome fillip for everyone, particularly investors. It is, therefore, imperative for investors to seize the opportunities this new technology offers.

All the signs point to them doing just that, albeit at a slow and cautious pace.

Originally published on Portfolio Institutional

.jpg)

%20(2).png)

-p-800.png)